option to tax form

Opting to tax is quite easy. Opting to tax land and buildings.

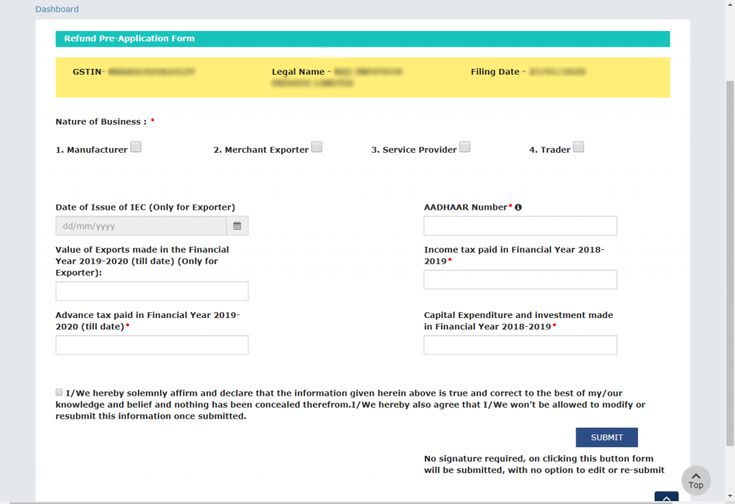

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

However as a landlord you can opt to tax the letting of certain properties.

. The timing of submission is important. The form lists six criteria and you have to fulfil the first one alone or all of the remaining five See VAT Notice 742A section 8. A typed drawn or uploaded signature.

When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422 b which provides the information needed for tax-reporting purposes. You can opt to tax one property at a time or all of the properties you own its your choice. Opting to tax is quite easy.

This means changing an exempt supply which you wont be able to recover VAT on into a taxable supply so VAT can be gained. Do hereby exercise withdraw the option referred to in clause i of sub-section 5 of section 115BAC of the Income-tax Act 1961 for previous year 20-and subsequent years. Option to tax land and buildings Tell HMRC about an option to tax land and buildings 4 March 2022 Form Stop being a relevant associate to an option to tax 15 May 2020 Form Revoke an option to tax.

View the updated form VAT1614C. When you exercise an incentive stock option ISO there are generally no tax consequences although you will have to use Form 6251 to determine if you owe any Alternative Minimum Tax AMT. Needless to say the paperwork in many cases will have been lost with the passing of time.

Please complete this form in black ink and use capital letters. The option to tax rules have been with us a long time since 1 August 1989 to be exact. Option to tax lettings Option to tax lettings The letting of a property is exempt from Value-Added Tax VAT.

You can revoke your option to tax after 20 years by completing a form VAT 1614J. Released 18 August 2022 HMRC have updated form VAT1614C which is used to revoke an option to tax land or buildings within the six-month cooling off period. This letter authorises the named person to act as our agent in all matters relating to the notification and submission of an option to tax on our behalf and in all matters covered in Part 1 Schedule 10 of the VAT Act 1994 unless otherwise specified in writing.

Our program works to guide you through the complicated filing process with ease helping to prepare your return correctly and if a refund is due put you on your way to receiving itShould a tax question arise we are always here help and are proud to offer qualified online tax support to all. But if you own multiple properties you can limit the option to tax a letting to one property or specified properties. The option to tax form can be found on HMRCs website and can be submitted with an electronic signature but HMRC has suggested that it will also require evidence that the signature is from someone authorised to make the option on behalf of the business.

You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC. There are three variants. Notification of a real estate election.

Before you can revoke the option to tax without having to obtain prior permission from HMRC you have to fulfil a number of criteria. The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs permission to opt because he has not made any previous exempt supplies in relation to the building see below re. This means that many property owners will have sent their option to tax elections to HMRC and received written confirmation of those options many years ago.

Log in to the income tax portal at wwwincometaxgovin Login to the portal using valid credentials Navigate the menu e-File Income Tax Forms File Income Tax Forms Form 10IE option Taxpayers can access the form 10IE option under the Persons with Business Profession Income tab. The address for sending completed forms and any supporting documents has been updated. Should I opt to tax.

You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and. The details for this purpose are given below.

Signed insert authorised signature as per table and date. The main reason a supplier would choose an option to tax is to recover VAT on associated costs. E-files online tax preparation tools are designed to take the guesswork out of e-filing your taxes.

Complete the Form 10IE Process Click on the option to File Now. Select Option 2 to request an IRS Tax Return Transcript and then enter 2020 If successfully validated tax filers can expect to receive a paper IRS Tax Return Transcript at the address included in their telephone request within 5 to 10 business days from the time the IRS receives the request. It would then charge VAT on any subsequent rental or sale of the property.

Decide on what kind of signature to create. Select the document you want to sign and click Upload. The vast majority of businesses dont need or choose to tax their trading premises.

IRS Tax Return Transcripts requested by telephone cannot be mailed to an address. In order to recover the VAT on the costs of purchasing or refurbishing a commercial property a property rental business will have to opt to tax the property and complete a form VAT 1614A and send it HMRC within 30 days of taking the decision to opt to tax. The real estate election makers details.

This can cause problems going forward. The legislation states that a business should notify HMRC within 30 days of opting to tax a commercial property using the form VAT1614A. Follow the step-by-step instructions below to design your vat1614a0209 form for notification of an option to tax opting to tax land and buildings.

Quite often businesses forget to do this and claim back the VAT on the purchase and charge VAT on the rents without notifying HMRC. You can opt to tax one property at a time or all of the properties you own its your choice. Send the completed form and supporting documents to the address as shown on page 2.

Name and address of the individual HUF having Permanent Account Number PAN.

Pin By Tricia Soltesz On Pta Donation Letter Pto Fundraiser Fundraising Letter

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Lodging Your Tax Return Blacktown

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Singapore Filing Taxes

Tax Due Dates Stock Exchange Due Date Tax

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Property Loan Info Verification Sheet 4 Real Estate Forms Lease Option Lettering

Blue Summit Supplies Tax Forms 1099 Misc 4 Part Tax Forms Bundle With Software And Self Seal Envelopes 25 Count

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

Rental Applications Form Free Printable Rental Application Rental Being A Landlord

Notes On Tax Planning Services

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

Income Tax Return Update Financepost In 2021 Finance Blog Finance Income Tax Return

A Tax Accountant Will Have The Option To Get All The Vital Archives And Structures Required For Filing The Tax Papers Arrange Tax Consulting Tax Help Budgeting

Collective Tax Prep Checklist Tax Prep Health Savings Account

Bill Of Lading Pdf Real Estate Forms Real Estate Forms Real Estate Contract Room Rental Agreement

Editable Option To Purchase Real Estate Contract Real Estate Etsy